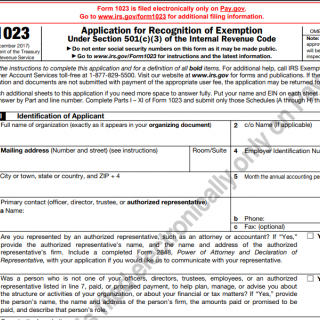

IRS Form 1023. Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code

IRS Form 1023 is an application for tax exemption under section 501(c)(3) of the Internal Revenue Code in the United States. This form is used by nonprofit organizations to apply for tax-exempt status from federal income tax.

The form consists of several parts, including basic organizational information, a narrative description of the organization's activities and mission, financial information, and supporting documents. The most important fields are those that provide information about the organization's purpose and activities, including a detailed description of the organization's programs and services, and how they benefit the community.

This form is typically compiled by nonprofit organizations that wish to apply for tax-exempt status under section 501(c)(3) of the Internal Revenue Code. The parties to the document are the nonprofit organization and the IRS.

When compiling this form, it is important to ensure that all information provided is accurate and complete. Any false or misleading information could potentially result in the denial of tax-exempt status. It is also important to provide detailed information about the organization's programs and services, as this will be used to determine whether the organization meets the requirements for tax-exempt status.

The advantages of this form are that it provides a way for nonprofit organizations to apply for tax-exempt status, which can provide significant financial benefits. Tax-exempt organizations are not required to pay federal income tax on their earnings, and donors to tax-exempt organizations may be able to deduct their donations from their taxable income.

However, there can be problems when filling out this form, such as providing inaccurate or incomplete information, or failing to meet the requirements for tax-exempt status. It is important to seek professional advice or guidance if there are any questions or concerns about filling out this form.

This form can be submitted to the IRS online or by mail. Once submitted, the IRS will review the form and any supporting documentation and determine whether the organization meets the requirements for tax-exempt status. Instances of this form are stored in the IRS's database for future reference and investigation.

Form 1023 is filed electronically only on Pay.gov. You may go to www.irs.gov/form1023 for additional filing information.