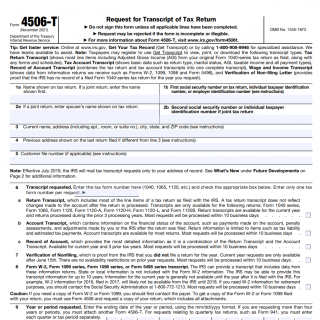

IRS Form 4506-T. Request for Transcript of Tax Return

Form 4506-T is a Request for Transcript of Tax Return form issued by the Internal Revenue Service (IRS). It is used to request a transcript or copy of a previously filed tax return or a Verification of Non-Filing Letter. Here is a detailed description of the form:

Parts of Form 4506-T:

- Part I: Requests for transcript of tax return

- Part II: Requests for Verification of Non-Filing Letter

- Part III: Third Party Designee

- Part IV: Signature and Date

Cases in which Form 4506-T is drawn up and parties involved:

- Individuals or entities who need a transcript or copy of a previously filed tax return or a Verification of Non-Filing Letter.

- Third-party designee, if applicable.

Features to take into account when compiling:

- The requester must complete all required fields, including name, address, and Social Security number or Employer Identification Number.

- The requester must indicate which type of transcript or letter they are requesting in Part I or Part II of the form.

- The requester must sign and date the form in Part IV.

- If a third-party designee is appointed, they must complete Part III of the form.

The advantages of using Form 4506-T include the ability to obtain a transcript of a tax return quickly and easily, without having to request a copy of the entire return. This can be useful for situations where only certain information is needed, such as verifying income for a loan application. Additionally, the form allows the taxpayer to designate a third party to receive the transcript, which can be helpful if the taxpayer is unable to obtain the transcript themselves.

However, there can be problems if the form is filled out incorrectly. For example, if the taxpayer provides inaccurate information or selects the wrong type of transcript, the request may be delayed or denied. It is also important to note that the transcript provided may not include all of the information that was on the original tax return, such as schedules or attachments.