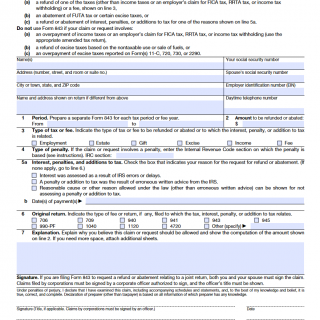

IRS Form 843. Claim for Refund and Request for Abatement

Form 843 is an IRS form used for requesting a refund or abatement of taxes. It is filed by taxpayers who have overpaid taxes, received excessive refunds, or need to request a tax credit. The form must be filled out in full and signed by the taxpayer or their authorized representative.

The information needed to fill out the form includes the taxpayer's name, address, Social Security Number, and the tax year for which the refund or abatement is being claimed. Additional information, such as the amount of the refund or tax credit being claimed, must also be included.

Once the form is submitted, the IRS will review the claim and process the refund or abatement as soon as possible.

Failing to file Form 843 accurately and in a timely manner can result in a penalty of up to 25% of the amount of the refund being claimed. Additionally, the IRS may impose a penalty for failure to pay tax when due, even if the taxpayer is due a refund. The penalty for this is usually 0.5% of the unpaid tax per month, up to 25% of the unpaid tax. It is important to ensure that the form is filled out accurately and in a timely manner to avoid any penalties.

Submitting Form 843 can help taxpayers get a refund of taxes, penalties, and interest that they have overpaid or been incorrectly charged. It can also help taxpayers receive credit for taxes that were paid on time but not credited. Additionally, filing Form 843 can help taxpayers avoid any penalties for failure to pay taxes when due.

Where to file form 843

When filing Form 843, the mailing address depends on the reason for the request. If you are responding to an IRS notice regarding certain taxes, such as income, employment, gift, estate, excise, etc., use the address provided in the notice.

If you are requesting a claim for refund in a Form 706/709 tax matter, send the form to the Internal Revenue Service Center at the following address:

Attn: E&G, Stop 824G

7940 Kentucky Drive

Florence, KY 41042-2915

For penalties or any other reason not related to an IRS notice, an estate tax claim for refund, or Letter 4658, send the form to the service center where you would file a current year tax return for the tax in question. Check the instructions for the tax return you are filing to determine the correct service center.

If you are responding to Letter 4658 regarding the branded prescription drug fee, write "Branded Prescription Drug Fee" on the top of Form 843 and send it to the following address:

Internal Revenue Service

Mail Stop 4921 BPDF

1973 N. Rulon White Blvd.

Ogden, UT 84404

Note that this address is only for claiming a refund of the branded prescription drug fee.

Finally, if you are requesting a net interest rate of zero, send the form to the service center where you filed your most recent tax return.