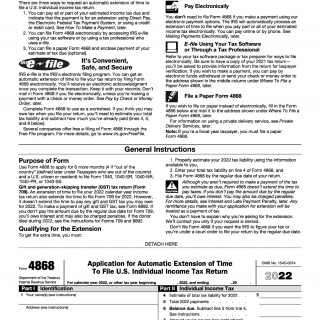

IRS Form 4868. Application for Automatic Extension of Time To File U.S. Individual Income Tax Return

Form 4868 is an application for an automatic extension of time to file a U.S. individual income tax return. It can be obtained from the IRS website or from a tax preparer. The form requires the taxpayer's name, address, Social Security number, and estimated tax liability. It also requires the taxpayer to indicate whether they are requesting an extension of time to file or an extension of time to pay. The form must be filed by the regular due date of the return. The taxpayer must also pay any taxes due by the regular due date of the return. The taxpayer can submit the form electronically or by mail. The form should be filled out by the taxpayer, and should be submitted to the IRS.

Form 4868 should be mailed to the IRS address listed on the form. Alternatively, taxpayers can use the IRS's Where to File tool to find the correct mailing address for their Form 4868. The form can be submitted electronically or by mail. Electronic filing is the fastest and most secure way to submit the form. Taxpayers can also submit the form by mail, but it may take longer for the IRS to process the form.

It is used to request an extension of the filing deadline, which is typically April 15th of each year. The form must be completed and submitted to the IRS by the original filing deadline. If approved, the extension will give the taxpayer an additional six months to file the return. The information on the form is used by the IRS to process the extension request and determine whether the taxpayer is eligible for the extension. The form also includes information about estimated tax payments and estimated income tax liability. The information provided on the form is used to calculate the taxpayer's estimated tax liability and determine if any additional taxes are due.

Mailing addresses for form 4868

| If you live in... | And you are not enclosing a payment use this address | And you are enclosing a payment use this address |

|---|---|---|

|

Arkansas, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0045 |

Internal Revenue Service P.O. Box 931300 Louisville, KY 40293-1300 |

| Pennsylvania |

Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0045 |

Internal Revenue Service P.O. Box 802503 Cincinnati, OH 45280-2503 |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, Ohio, Oregon, North Dakota, South Dakota, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0045 |

Internal Revenue Service P.O. Box 802503 Cincinnati, OH 45280-2503 |

| Florida, Louisiana, Mississippi, Texas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0045 |

Internal Revenue Service P.O. Box 1302 Charlotte, NC 28201-1302 |

| Arizona, New Mexico |

Department of the Treasury

|

Internal Revenue Service |

| Alabama, Georgia, North Carolina, South Carolina, Tennessee | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0045 |

Internal Revenue Service P O Box 1302 Charlotte, NC 28201-1302 |

| A foreign country, U.S. possession or territory*, or use an APO or FPO address, or file Form 2555, 2555-EZ, or 4563, or are a dual-status alien.

|

Department of the Treasury Internal Revenue Service Austin, TX 73301-0215 USA |

Internal Revenue Service P.O. Box 1303 Charlotte, NC 28201-1303 USA |