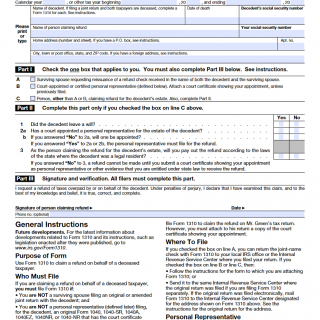

IRS Form 1310. Statement of Person Claiming Refund Due a Deceased Taxpayer

Form 1310 is a form used by taxpayers to claim a refund of taxes for a deceased individual. It is filed with the Internal Revenue Service (IRS) to request a refund for taxes that were overpaid, incorrectly paid, or paid on time but not credited.The form must be filled out accurately and in a timely manner, as failing to do so can lead to delays or even the denial of the refund. The form should include information such as the name, Social Security number, and date of death of the deceased taxpayer, as well as the name and address of the executor or administrator of the estate. The form should be signed and dated by the executor or administrator and mailed to the IRS.

Submitting Form 1310 can help taxpayers get a refund of taxes, penalties, and interest that the deceased taxpayer has overpaid or been incorrectly charged. It can also help taxpayers receive credit for taxes that were paid on time but not credited. Additionally, filing Form 1310 can help taxpayers avoid any penalties for failure to pay taxes when due.

Failing to file Form 1310 accurately and in a timely manner can result in a penalty of up to 25% of the amount of the refund being claimed. Additionally, the IRS may impose a penalty for failure to pay tax when due, even if the taxpayer is due a refund. The penalty for this is usually 0.5% of the unpaid tax per month, up to 25% of the unpaid tax. It is important to ensure that the form is filled out accurately and in a timely manner to avoid any penalties.

The IRS will use the information provided on Form 1310 to process any refund due to the deceased taxpayer. They may also use it to verify the identity of the executor or administrator of the estate, and to determine the amount of any refund due.

Form 1310 is a Statement of Person Claiming Refund Due a Deceased Taxpayer, while Form 3911 is a Taxpayer Statement Regarding Refund and Form 843 is a Claim for Refund and Request for Abatement. Form 1310 is used to claim a refund due to a deceased taxpayer. It must be signed by the executor or administrator of the estate of the deceased taxpayer, or by the surviving spouse, if any.