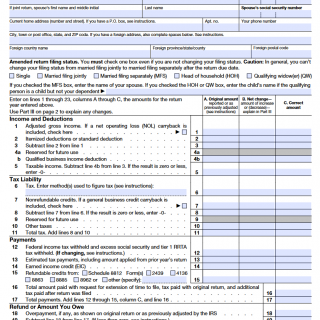

IRS Form 1040-X

The 1040X is an IRS form used to amend a previously filed tax return. It is used by individuals, sole proprietors, and certain corporations to correct errors in their previously filed tax returns. The form is divided into four parts: the payment voucher, the worksheet, the worksheet for calculating the amount of tax due, and the payment voucher.

The payment voucher is used to calculate the amended taxes for the current tax year. It includes information such as the taxpayer's name, Social Security Number, address, filing status, amended income, and amended deductions.

The worksheet is used to calculate the amount of amended tax that is due. It includes information such as the taxpayer's filing status, amended income, and amended deductions.

The worksheet for calculating the amount of tax due is used to determine the amount of amended tax that is due. It includes information such as the taxpayer's filing status, amended income, amended deductions, and amended tax credits.

The payment voucher is used to make the amended tax payment. It includes information such as the taxpayer's name, Social Security Number, address, filing status, and payment information.

The 1040X form is used by individuals, sole proprietors, and certain corporations to amend their previously filed tax returns. It is important to note that the 1040X form is different from the 1040 form, which is the regular tax return form used by individuals. The 1040X form is used to amend a previously filed tax return, while the 1040 form is used to calculate regular taxes.