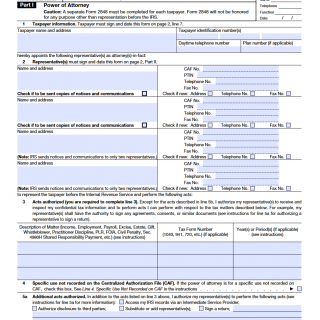

IRS Form 2848. Power of Attorney and Declaration of Representative

IRS Form 2848 is a Power of Attorney and Declaration of Representative form used by individuals and businesses to authorize someone else to act on their behalf with the Internal Revenue Service (IRS) for tax-related matters.

The form consists of several parts, including:

- Taxpayer Information: This section requires the taxpayer's name, address, and taxpayer identification number (Social Security Number or Employer Identification Number).

- Representative Information: This section requires the representative's name, address, and taxpayer identification number (Social Security Number or Employer Identification Number).

- Tax Matters: This section identifies specific tax matters that the representative is authorized to handle on behalf of the taxpayer.

- Retention/Revocation of Prior Power(s) of Attorney: This section allows the taxpayer to revoke any prior powers of attorney they may have granted to other individuals or organizations.

- Signature: This section requires both the taxpayer's and representative's signatures, as well as the date.

The IRS Form 2848 is drawn up when individuals or businesses need to assign an attorney, accountant or other representative to act on their behalf for tax-related matters such as filing tax returns, responding to audits or inquiries by the IRS or claiming a refund. The parties involved are the taxpayer and the representative.

When compiling the IRS Form 2848, it's important to ensure that the form is completed accurately and in full detail. The form should clearly state the specific tax matters that the representative is authorized to handle, and the representative should only act within that specific scope. The form must also be signed and dated by both the taxpayer and the representative.

The advantage of using the IRS Form 2848 is that it allows the taxpayer to assign someone they trust to handle their tax-related matters. This can help reduce stress and ensure that their tax obligations are timely and accurately met. However, problems can arise if the form is not filled out correctly. For example, if the representative exceeds their authority or the form contains errors, the taxpayer may be held responsible for any legal or financial consequences that result.

In summary, the IRS Form 2848 is a powerful legal document that can give a representative the authorization to act on a taxpayer's behalf with the IRS. It requires careful consideration and should only be filled out by those who completely understand the rights they're giving up and the obligations the representative is taking on.