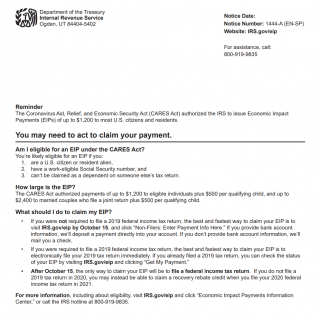

IRS Form 1444

IRS Form 1444, titled "Your Economic Impact Payment," is a document that confirms an individual's receipt of their stimulus payment. The form is sent by the IRS to individuals who received a stimulus payment via direct deposit or a paper check in the mail. The form consists of four parts: Taxpayer Information, Payment Information, Certification, and Contact Information.

In the Taxpayer Information section, the individual must provide their name, social security number, and current address. The Payment Information section specifies the amount of the stimulus payment and the method of delivery (direct deposit or paper check). The Certification section requires the individual's signature, certifying that they received the economic impact payment on the date listed.

The form is drawn up in cases where the individual has received their stimulus payment, but they require documentation to confirm receipt. The parties involved in the form's creation are the individual and the IRS.

When compiling the form, individuals should ensure that all information provided is accurate. They should ensure that they sign and date the form correctly and that they include accurate contact information. Any errors in the form could result in the IRS rejecting the form or delaying the processing of the individual's tax refund.

The form's advantages are that it provides individuals with official documentation of their receipt of the stimulus payment, which may be required for various purposes, such as applying for a loan or government aid. However, incorrect completion of the form may lead to delays or rejection, resulting in further complications.

In summary, IRS Form 1444 is a confirmation of an individual's receipt of their stimulus payment. Individuals should ensure that they complete the form accurately to avoid complications and ensure proper documentation.