IRS Form 1040-NR

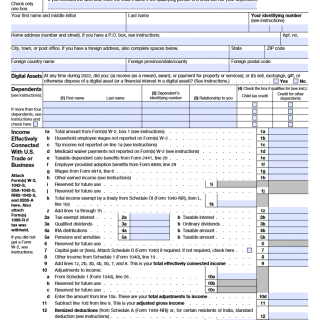

The 1040NR is an Internal Revenue Service (IRS) form used by nonresident aliens to report their income and deductions from sources within the United States. The form must be completed and filed by individuals who are not U.S. citizens, residents, or green card holders and who receive income from sources within the United States.

The form is similar to the 1040 form used by U.S. residents, but it contains additional information that nonresident aliens must provide. The form requires taxpayers to report their income, deductions, and credits, and then calculate their tax liability. The 1040NR also requires taxpayers to report their foreign financial assets and interests, including foreign bank accounts and investments. Additionally, the form requires taxpayers to provide information about their visas, passport numbers, and country of residence.

Once the form is completed, taxpayers must pay any taxes due or receive a refund for any taxes overpaid.

If a taxpayer fails to file the 1040NR form or fails to pay any taxes due, they may be subject to penalties, interest, or both. The IRS may impose a penalty of up to 5% of the taxes due for each month or part of a month that the taxpayer is late in filing or paying the taxes. Additionally, the IRS may impose interest charges on the unpaid taxes.

The interest rate is determined by the IRS and is currently 3%. If the taxpayer willfully fails to file the 1040NR, they may be subject to a penalty of up to $10,000 or up to 5 years in prison. It is important to note that the IRS may waive penalties and interest charges if the taxpayer can demonstrate reasonable cause for not filing or paying the taxes.

The 1040NR form must be completed and signed by the taxpayer and then mailed to the IRS. The form should be sent to the IRS address specified on the form. Alternatively, the form can be filed electronically by using the IRS e-file system. Electronic filing is the fastest and most accurate way to submit the form. Taxpayers can also use tax preparation software to complete and submit the form.