IRS Form W-4P. Withholding Certificate for Periodic Pension or Annuity Payments

IRS Form W-4P, also known as Withholding Certificate for Periodic Pension or Annuity Payments, is a form used by pension or annuity recipients to inform their payer how much federal income tax should be withheld from their periodic payments. The main purpose of the form is to ensure that the correct amount of federal income tax is withheld based on the recipient's personal circumstances, such as marital status and number of dependents.

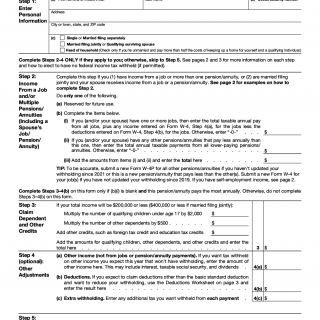

The form consists of three parts, including personal information, withholding election, and signature and date. Important fields on the form include the recipient's full legal name, Social Security number, filing status, and allowances. It is important for recipients to accurately complete the form, as any errors or omissions can result in incorrect withholding and potential tax penalties.

The parties involved in the form are the pension or annuity recipient and the payer. The recipient is responsible for filling out the form and submitting it to their payer, while the payer is responsible for using the information on the form to calculate and withhold the correct amount of federal income tax from the recipient's periodic payments.

When filling out the form, recipients will need to provide information about their personal and financial situation, such as their marital status and number of dependents. No additional documents need to be attached to the form.

Examples of when a pension or annuity recipient may need to fill out a Form W-4P include when they begin receiving payments, when there are changes to their personal or financial situation, or when they want to adjust the amount of federal income tax withheld from their payments.

Strengths of the form include its simplicity and ease of use, while weaknesses include the potential for errors or misunderstandings. Opportunities for improvement include simplifying the form even further and providing more guidance for recipients on how to complete it accurately. Threats related to the form include potential tax penalties for incorrect withholding.

Related forms include Form W-4, which is used by employees to inform their employer how much federal income tax should be withheld from their paycheck, and Form W-9, which is used by independent contractors to provide their taxpayer identification number to their clients. An alternative form to Form W-4P is the IRS Withholding Calculator, which can help recipients determine how much federal income tax should be withheld from their periodic payments.

To fill out and submit Form W-4P, recipients should download the form from the IRS website, complete it accurately, and submit it to their payer. The payer will then use the information on the form to calculate and withhold the correct amount of federal income tax from the recipient's periodic payments. The form should be stored in a safe place for future reference.