IRS Form 1040-ES. Estimated Tax for Individuals

The 1040-ES is an IRS form used to calculate estimated taxes. It is used by individuals, sole proprietors, and certain corporations to estimate and pay their taxes. The form is divided into four parts: the payment voucher, the worksheet, the worksheet for calculating the amount of tax due, and the payment voucher.

The payment voucher is used to calculate the estimated taxes for the current tax year. It includes information such as the taxpayer's name, Social Security Number, address, filing status, estimated income, and estimated deductions.

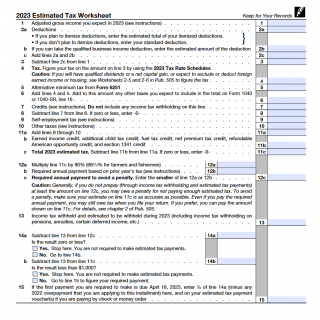

The worksheet is used to calculate the amount of estimated tax that is due. It includes information such as the taxpayer's filing status, estimated income, and estimated deductions.

The worksheet for calculating the amount of tax due is used to determine the amount of estimated tax that is due. It includes information such as the taxpayer's filing status, estimated income, estimated deductions, and estimated tax credits.

You must pay estimated tax for 2023 if you expect to owe at least $1,000 in tax for 2023 and your withholding and refundable credits are less than 90% of the tax to be shown on your 2023 tax return or 100% of the tax shown on your 2022 tax return (your 2022 tax return must cover all 12 months). However, if you were a U.S. citizen or resident alien for all of 2022 and you had no tax liability for the full 12-month 2022 tax year, you don't have to pay estimated tax for 2023. Farmers, fishermen, and higher income taxpayers may have different percentages.

The payment voucher is used to make the estimated tax payment. It includes information such as the taxpayer's name, Social Security Number, address, filing status, and payment information.

The 1040-ES form is used by individuals, sole proprietors, and certain corporations to estimate and pay their taxes. It is important to note that the 1040-ES form is different from the 1040 form, which is the regular tax return form used by individuals. The 1040-ES form is used to calculate estimated taxes, while the 1040 form is used to calculate regular taxes.