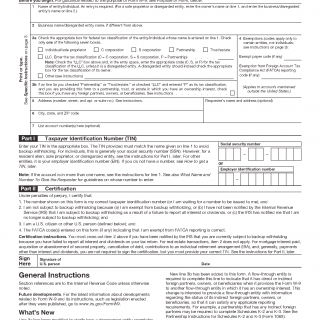

IRS Form W-9. Request for Taxpayer Identification Number and Certification

IRS Form W-9 is an official U.S. tax document used to request a taxpayer identification number (TIN) and a certification of U.S. taxpayer status. The form is issued by the Internal Revenue Service and is used for federal information reporting and withholding purposes.

Purpose of Form W-9

Form W-9 is used by a requester to obtain a payee’s correct name, taxpayer identification number, and required certifications. The information collected on the form allows the requester to accurately report payments and determine whether backup withholding applies under U.S. tax law.

Form W-9 is a request and certification document. It is not a tax return and is not filed with the IRS by the individual or entity completing the form.

Who Uses Form W-9

Form W-9 is used by U.S. persons, including individuals and entities, who receive payments that may be subject to U.S. information reporting.

Common users include individuals, sole proprietors, and U.S.-organized businesses that receive reportable payments from requesters required to file information returns.

What Information Form W-9 Collects

Form W-9 collects the following information:

- legal name of the individual or entity;

- business or disregarded entity name, if applicable;

- federal tax classification;

- taxpayer identification number (SSN, EIN, or ITIN);

- certifications regarding U.S. status and backup withholding.

What Form W-9 Is Not Used For

Form W-9 is not used to:

- file income tax returns;

- report income directly to the IRS;

- establish foreign tax status;

- replace Forms W-8 or other foreign status documentation.

How Form W-9 Is Used

A completed Form W-9 is provided directly to the requester. The requester retains the form to support information reporting and withholding determinations.

The information from Form W-9 may later be used by the requester to prepare information returns, such as Forms 1099, that are filed with the IRS.

Filing and Submission

Form W-9 is not submitted to the IRS by the payee. It is given to the person or business requesting the information.

Requesters may accept Form W-9 in paper or electronic format, provided the required certifications are properly obtained.

Processing and Validity

Form W-9 does not have a fixed expiration date. It generally remains valid until the information provided changes or an updated form is required by the requester.

Related Explanations

For detailed explanations of when and why Form W-9 is requested and how it is used in practice, see: