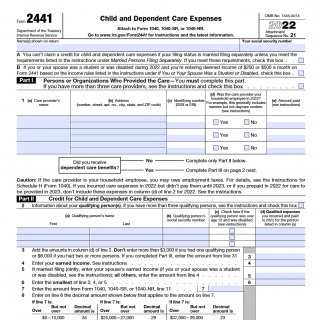

IRS Form 2441. Child and Dependent Care Expenses

Form 2441, also known as Child and Dependent Care Expenses, is a tax form used to claim a credit for expenses incurred for the care of qualifying individuals. The form consists of two parts: Part I is used to calculate the credit, while Part II is used to report information about the care provider(s).

This form is drawn up by taxpayers who have incurred expenses for the care of a qualifying individual, such as a child under age 13, a disabled spouse, or a disabled dependent. To be eligible for the credit, the taxpayer must have earned income and must have paid for care so that they could work or look for work. The care must have been provided by someone who is not the taxpayer's spouse or a dependent.

When compiling this form, it is important to keep in mind that the credit is limited to a maximum of $3,000 for one qualifying individual or $6,000 for two or more qualifying individuals. Additionally, the credit is calculated as a percentage of the qualifying expenses, ranging from 20% to 35% depending on the taxpayer's income.

The advantages of this form are that it can provide a significant credit for taxpayers who have incurred child or dependent care expenses, which can help lower their tax bill. However, if the form is filled out incorrectly, there can be problems with the IRS, such as delays in processing the return or even an audit. It is important to ensure that all information reported on the form is accurate and that all supporting documentation is included to avoid any issues with the IRS.

It is important to note that Form 2441 is an attachment to Form 1040, 1040-SR, or 1040-NR. Taxpayers must complete and file Form 2441 along with their federal income tax return in order to claim the credit for child and dependent care expenses. Failure to attach Form 2441 to the tax return may result in the taxpayer not receiving the credit for which they are eligible.