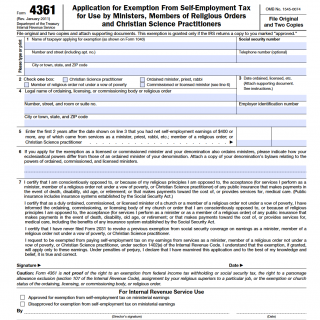

IRS Form 4361

IRS Form 4361 is an application for exemption from self-employment tax for certain members of the clergy and religious workers. This form is used to request an exemption from paying Social Security and Medicare taxes on income earned by ministers, members of religious orders, and Christian Science practitioners.

Form 4361 consists of several parts, including:

Part 1: This section requires basic information about the applicant, such as their name, address, and Social Security Number.

Part 2: This section requires information about the applicant's religious organization, including its name, address, and tax identification number.

Part 3: This section requires the applicant to certify that they are a member of the clergy or a religious worker and that they have filed all required tax returns.

Part 4: This section requires the applicant to certify that they oppose, either conscientiously or because of religious principles, the acceptance of any public insurance that makes payments in the event of death, disability, old age, or retirement.

Part 5: This section requires the applicant to certify that they have informed their religious organization that they are applying for exemption from self-employment tax.

Form 4361 is drawn up by members of the clergy and religious workers who meet certain requirements. To qualify for the exemption, the applicant must be a duly ordained, commissioned, or licensed minister of a church, a member of a religious order who has not taken a vow of poverty, or a Christian Science practitioner. The applicant must also have a conscientious objection to accepting public insurance that makes payments in the event of death, disability, old age, or retirement.

The parties involved in Form 4361 are the applicant and the IRS. The applicant is responsible for accurately completing the form and submitting it to the IRS, while the IRS reviews the application and makes a determination on whether to grant the exemption.

When compiling Form 4361, applicants should take several features into account, such as:

- Ensuring that they meet the eligibility requirements for the exemption.

- Providing accurate and complete information on the form.

- Making sure that they have informed their religious organization of their application.

The advantages of Form 4361 include:

- It allows members of the clergy and religious workers to request an exemption from self-employment tax on income earned from their religious work.

- It recognizes the unique status of members of the clergy and religious workers in the tax system.

- It provides a way for individuals to express their conscientious objection to certain types of public insurance.

However, there can be problems if Form 4361 is filled out incorrectly. These problems can include:

- Rejection of the application by the IRS.

- Penalties and interest charges for late or inaccurate filings.

- Incorrect tax liability calculations, which can result in overpayments or underpayments of taxes.

In summary, Form 4361 is an important application for members of the clergy and religious workers who wish to request an exemption from self-employment tax on income earned from their religious work. It consists of several parts and requires accurate and complete information to be filed correctly. Failure to file Form 4361 or filing it incorrectly can result in penalties, interest charges, and other problems.