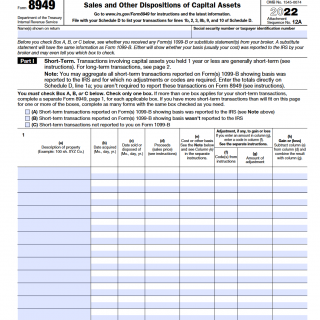

IRS Form 8949. Sales and Other Dispositions of Capital Assets

IRS Form 8949 is a tax form used to report capital gains and losses on investments during the tax year. It is used by individuals, partnerships, and corporations that have created a taxable event on a sale or exchange of a capital asset.

The form consists of two parts. Part 1 is used to report short-term capital gains and losses from assets held for one year or less, while Part 2 is used to report long-term capital gains and losses from assets held for more than one year. The form also includes columns to report the date of acquisition and sale, the proceeds from the sale, the cost of the asset, and the amount of gain or loss.

The form is used in various cases where a person or organization has made a capital gain or loss on investments. This could be through selling stocks, bonds, mutual funds, or property. The parties involved are the person or organization making the capital gain or loss and the IRS.

When compiling Form 8949, it is important to ensure that all transactions are accurately reported, with the correct dates of acquisition and sale, and the correct amounts of proceeds and costs. It is also important to take into account any adjustments or modifications that may affect capital gains or losses.

The advantages of using Form 8949 is that it allows individuals and organizations to report their capital gains and losses in a clear and concise manner, and helps to ensure that they comply with IRS regulations. If the form is filled out incorrectly, however, it may result in errors in reporting, which could lead to penalties, fines, or other legal consequences.

Overall, Form 8949 is an important tax form used to report capital gains and losses, and should be completed accurately and in a timely manner to avoid any issues. It is recommended that taxpayers seek the guidance of a qualified tax professional to ensure that they are reporting correctly and minimizing any potential risks.

Effective Strategies for Minimizing Taxes with IRS Form 8949: A Comprehensive Guide

To effectively use IRS Form 8949 to minimize your tax rate, it is important to consider the following strategies:

1. Tax loss harvesting: If you have investments that have lost value, you may consider selling them to realize a loss, which can be used to offset gains from other investments. This can be done by entering the losses on Form 8949 and using them to offset other capital gains, ultimately reducing your taxable income.

2. Holding period: The tax rate on long-term capital gains is generally lower than that of short-term gains, so holding investments for more than one year may reduce your tax rate. This means that you'll want to report your long-term gains separately from your short-term gains on Form 8949.

3. Matching purchases and sales: When selling investments, it is important to match the sale with the purchase based on the date and cost. This will ensure that the correct holding period is applied and that the correct cost basis is used when calculating gains and losses.

4. Accurately reporting all sales and dispositions: It is important to ensure that all sales and dispositions of assets are accurately reported on Form 8949. Failing to report all transactions could result in an audit or penalties.

5. Careful consideration of tax implications before selling assets: If you are considering selling assets, it is important to evaluate the tax implications of the sale. For example, if you sell multiple assets at the same time, the gains or losses from those sales may interact with each other in a way that could affect your tax rate.

Overall, the effective usage of IRS Form 8949 to minimize your tax rate requires careful planning and attention to detail. By adopting the above strategies, you can reduce your tax bill and ensure you are accurately reporting your capital gains and losses. It is important to work with a qualified tax professional to ensure that you are complying with all applicable tax laws and regulations.