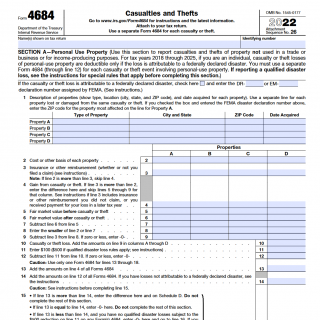

IRS Form 4684. Casualties and Thefts

IRS Form 4684 is used to report losses due to casualties and thefts that are not covered by insurance or other means of reimbursement. The form consists of three parts:

Part I: Calculation of Losses - This section is used to calculate the amount of the loss and to determine the deductible amount.

Part II: Gains and Reimbursements - This section is used to report any gains or reimbursements received as a result of the loss.

Part III: Explanation of Casualty or Theft - This section is used to provide a detailed explanation of the circumstances surrounding the loss.

This form is drawn up in cases where a taxpayer experiences a loss due to a casualty or theft that is not covered by insurance or other means of reimbursement. This can include losses due to natural disasters, fires, floods, thefts, and other similar events.

The parties involved in this form are the taxpayer who experienced the loss and the IRS, who will use the form to determine the amount of the loss and any applicable deductions.

When compiling this form, it's important to keep accurate records of the loss, including the date and cause of the loss, the value of the property before and after the loss, and any insurance or other reimbursements received.

The advantages of this form include the ability to claim a deduction for losses that are not covered by insurance or other means of reimbursement. However, problems can arise if the form is filled out incorrectly or if the taxpayer is unable to provide adequate documentation to support their claim. In these cases, the IRS may disallow the deduction or require additional documentation to support the claim.

In summary, IRS Form 4684 is used to report losses due to casualties and thefts that are not covered by insurance or other means of reimbursement. It consists of three parts and is drawn up in cases where a taxpayer experiences a loss due to a casualty or theft. To avoid problems, it's important to keep accurate records and fill out the form correctly.