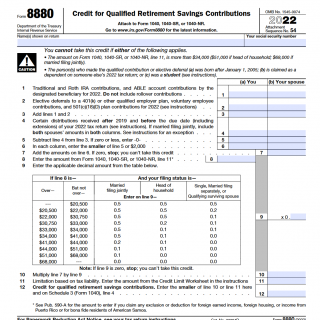

IRS Form 8880. Credit for Qualified Retirement Savings Contributions

IRS Form 8880, Credit for Qualified Retirement Savings Contributions, is a tax form used to claim a credit for contributions made to a qualified retirement savings plan. The form consists of two parts: Part I is used to calculate the credit, while Part II is used to report information about the retirement plan.

This form is drawn up by taxpayers who have made contributions to a qualified retirement savings plan, such as a traditional or Roth IRA, a 401(k), or a 403(b). To be eligible for the credit, the taxpayer must have been at least 18 years old, not a full-time student, and must not have been claimed as a dependent on someone else's tax return. The credit is also subject to income limitations and caps, which vary depending on the taxpayer's filing status and adjusted gross income.

When compiling this form, it is important to keep in mind that the credit is non-refundable, which means that it can only be used to reduce the taxpayer's tax liability to zero. Additionally, the credit is calculated as a percentage of the contributions made to the retirement plan, ranging from 10% to 50% depending on the taxpayer's income.

The advantages of this form are that it can provide a significant credit for taxpayers who have made contributions to a qualified retirement savings plan, which can help lower their tax bill. However, if the form is filled out incorrectly, there can be problems with the IRS, such as delays in processing the return or even an audit. It is important to ensure that all information reported on the form is accurate and that all supporting documentation is included to avoid any issues with the IRS.

Form 2441 is an attachment to Form 1040, 1040-SR, or 1040-NR. It is used to claim a credit for child and dependent care expenses incurred while the taxpayer or their spouse worked or looked for work.

Tips for reducing your tax bill with this form:

1. Keep accurate records: Make sure to keep receipts and records of all child and dependent care expenses throughout the year, as they will be needed to fill out Form 2441.

2. Know the limits: The maximum amount of expenses that can be claimed on Form 2441 is $3,000 for one qualifying individual, or $6,000 for two or more qualifying individuals. The credit is generally worth 20-35% of eligible expenses, depending on the taxpayer's income.

3. Consider employer-sponsored plans: Many employers offer dependent care flexible spending accounts (FSAs) or dependent care assistance programs (DCAPs) that can help reduce out-of-pocket expenses and increase the amount of the credit.

4. Understand who qualifies: To claim the credit, the taxpayer must have earned income and the expenses must be incurred for the care of a qualifying child or dependent who is under the age of 13 or disabled.

5. Properly fill out the form: It's important to fill out Form 2441 correctly and accurately to avoid errors or delays in processing. Seek the help of a tax professional or use tax software if necessary.