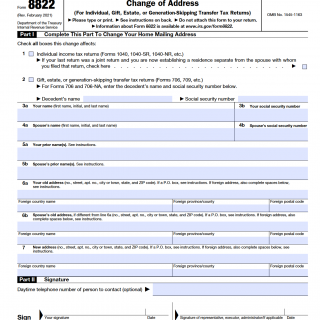

IRS Form 8822. Change of Address

IRS Form 8822 is used by individuals to notify the Internal Revenue Service of a change in their home mailing address. This form allows the IRS to update its records so that tax-related correspondence is sent to the correct address.

Purpose of IRS Form 8822

The purpose of Form 8822 is to report a change in an individual’s home mailing address. It applies to address changes connected to personal tax matters and individual filings.

This form is not used to update business addresses or information related to entities that use an Employer Identification Number (EIN).

Who Should File Form 8822

Form 8822 is filed by individuals who have changed their home mailing address and want the IRS to update its records. This may include individuals who:

- Moved to a new residence

- Changed apartments or housing units

- Established a separate residence after filing a joint return

An executor, administrator, or authorized representative may also file Form 8822 on behalf of an individual when permitted.

What Information Form 8822 Updates

Form 8822 updates the home mailing address the IRS uses for correspondence related to:

- Individual income tax returns

- Gift tax returns

- Estate or generation-skipping transfer tax returns

What Form 8822 Does Not Update

Form 8822 does not update business mailing addresses, business locations, or responsible party information.

Address changes related to businesses or organizations with an EIN must be reported using Form 8822-B.

How Form 8822 Is Filed

Form 8822 is filed by mail and should not be attached to a tax return. The completed form is sent to the IRS address listed in the official instructions, based on the individual’s prior address.

Processing Time

After Form 8822 is received, it generally takes several weeks for the IRS to process the address change and update its records.