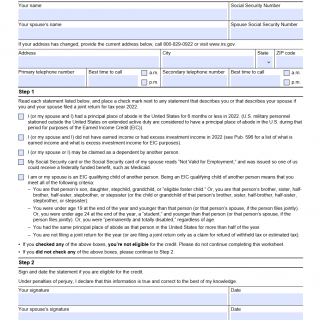

IRS Form 15112. Earned Income Credit Worksheet (CP 27)

IRS Form 15112 is a document used by the Internal Revenue Service (IRS) to request additional information from taxpayers who have filed a Form 1040 series return. The form is typically used when the IRS needs more information to verify the accuracy of the taxpayer's return.

The form consists of several parts. The first part identifies the taxpayer and the tax year in question. The second part contains a series of questions related to the items reported on the taxpayer's return. The questions may relate to income, deductions, credits, or other items reported on the return.

IRS Form 15112 is typically drawn up in cases where the IRS has reason to believe that the taxpayer's return may contain errors or inaccuracies. The form is used to request additional information from the taxpayer to help verify the accuracy of the return.

The parties involved in IRS Form 15112 are the taxpayer and the IRS. The taxpayer is required to complete the form and provide any additional information requested by the IRS. The IRS will use the information provided by the taxpayer to verify the accuracy of the return and determine if any additional taxes are owed.

When compiling IRS Form 15112, it is important to take into account several features. First, the form should be completed accurately and in a timely manner. Failure to respond to the IRS's request for additional information can result in penalties and interest charges. Additionally, the taxpayer should provide all requested information to the best of their ability. Providing incomplete or inaccurate information can lead to further questions from the IRS and potential legal issues.

The advantage of IRS Form 15112 is that it provides an opportunity for taxpayers to provide additional information to the IRS to help verify the accuracy of their return. This can help prevent potential issues down the line and ensure that the taxpayer is in compliance with applicable tax laws and regulations.

If IRS Form 15112 is filled out incorrectly, there can be several problems. Providing incomplete or inaccurate information can lead to further questions from the IRS and potential legal issues. Additionally, failure to respond to the IRS's request for additional information can result in penalties and interest charges. It is important to take the form seriously and provide accurate and complete information in a timely manner to avoid potential issues with the IRS.

CP27 Notice

The CP27 Notice is a notification that the IRS sends to taxpayers when they have failed to file a tax return for a specific tax year. The notice informs the taxpayer that the IRS has calculated their tax liability based on the information available to them, and that the taxpayer owes a certain amount of money.

The CP27 Notice is usually sent out after the tax filing deadline has passed and the taxpayer has not filed their return. The notice will include a breakdown of the tax, penalties, and interest owed, as well as instructions on how to pay the balance due.

It is important to note that the IRS can only calculate the tax liability based on the information they have, which may not be accurate or complete. Therefore, it is highly recommended that taxpayers file their tax returns even if they cannot pay the full amount owed. Ignoring the CP27 Notice can result in further penalties and interest charges.

To solve a CP27 Notice case, taxpayers have several options. They can pay the balance in full, set up a payment plan with the IRS, or request an offer in compromise, which is a settlement agreement with the IRS to pay a reduced amount. Taxpayers can also file an amended tax return if they believe the IRS's calculation is incorrect.

Examples of when a CP27 Notice may be issued include:

- A taxpayer fails to file a tax return for a specific year.

- A taxpayer files a tax return, but the IRS determines that the information reported is incomplete or inaccurate.

- A taxpayer has income reported to the IRS from a third party, such as an employer or financial institution, but the taxpayer does not report the income on their tax return.

In summary, if you receive a CP27 Notice, it is important to take action and respond promptly. Contacting the IRS or a tax professional can help you determine the best course of action to resolve the issue and avoid further penalties and interest charges.