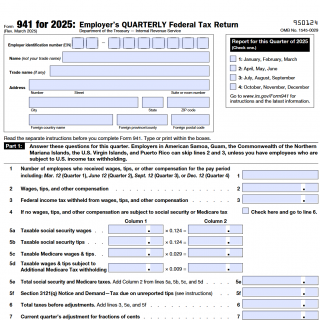

IRS Form 941. Employer’s QUARTERLY Federal Tax Return

IRS Form 941 is a quarterly tax return form that employers in the United States use to report the wages, tips, and other compensation paid to their employees, as well as the taxes withheld from their paychecks. Form 941 is used to report federal income tax, Social Security tax, and Medicare tax, as well as any additional Medicare tax withheld.

Form 941 consists of several parts, including:

- Part 1: This section requires basic information about the employer, such as their name, address, and Employer Identification Number (EIN).

- Part 2: This section requires information about the wages, tips, and other compensation paid to employees during the quarter, as well as the taxes withheld from their paychecks.

- Part 3: This section requires information about any adjustments made to the taxes reported in Part 2, such as corrections to Social Security or Medicare tax.

- Part 4: This section requires information about any deposits made during the quarter to cover the taxes reported in Parts 2 and 3.

- Part 5: This section requires information about any tax credits claimed during the quarter, such as the credit for sick and family leave or the employee retention credit.

Form 941 is typically drawn up by employers who have employees on their payroll. It is filed quarterly, and the due dates for each quarter are April 30, July 31, October 31, and January 31 of the following year. Employers must file Form 941 even if they have no employees during the quarter.

The parties involved in Form 941 are the employer and the IRS. The employer is responsible for accurately reporting the wages and taxes withheld from their employees' paychecks, while the IRS uses the information reported on Form 941 to ensure that the correct amount of taxes is being paid.

When compiling Form 941, employers should take several features into account, such as:

- Ensuring that the information reported is accurate and complete.

- Calculating the taxes withheld from employees' paychecks correctly.

- Making sure that the correct tax rates are used for Social Security and Medicare tax.

- Reporting any adjustments or tax credits accurately.

The advantages of Form 941 include:

- It allows employers to report their payroll taxes on a quarterly basis, rather than on a yearly basis.

- It helps employers ensure that they are withholding the correct amount of taxes from their employees' paychecks.

- It allows the IRS to monitor and enforce compliance with payroll tax laws.

However, there can be problems if Form 941 is filled out incorrectly. These problems can include:

- Penalties and interest charges for late or inaccurate filings.

- Audits or investigations by the IRS.

- Incorrect tax liability calculations, which can result in overpayments or underpayments of taxes.

In summary, Form 941 is an important tax return form that employers use to report their payroll taxes on a quarterly basis. It consists of several parts and requires accurate and complete information to be filed correctly. Failure to file Form 941 or filing it incorrectly can result in penalties, interest charges, and other problems.

Where to mail Form 941

| Your location ... | Mail return without payment ... | Mail return with payment ... |

|---|---|---|

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin |

Department of the Treasury |

Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

| No legal residence or principal place of business in any state: | Internal Revenue Service PO Box 409101 Ogden, UT 84409 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

| Special filing address for exempt organizations; governmental entities; and Indian tribal governmental entities; regardless of location | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |