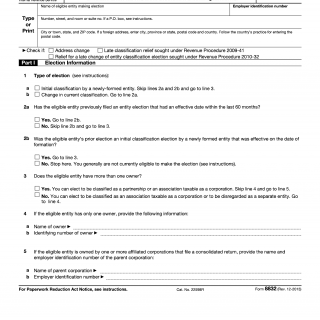

IRS Form 8832. Entity Classification Election

Form 8832, Entity Classification Election, is a tax form used by eligible entities to elect how they want to be classified for federal tax purposes. The purpose of this form is to allow entities to choose their tax classification, either as a corporation or partnership, for example, based on their specific tax goals and needs.

The form consists of three parts, including the election, the effective date, and the signatures of all members or owners of the entity. The important fields include the entity's name, address, tax identification number, and the desired tax classification.

The parties involved in this form are the entity and its members or owners. It is important to consider the entity's overall tax goals and the potential tax implications of each classification when compiling this form.

The data required when compiling the form includes the entity's name, address, tax identification number, and the desired tax classification. Additionally, the form must be signed by all members or owners of the entity.

Documents that must be attached additionally are not required, but the entity may need to provide supporting documentation to justify their chosen tax classification.

Application examples and practice and use cases include an LLC that wants to be taxed as a partnership or a corporation, or a partnership that wants to be taxed as an S corporation.

Strengths of this form include the flexibility it offers in choosing the entity's tax classification, as well as the potential tax benefits that may come with the chosen classification. Weaknesses may include the complexity of the form and the potential for the entity to make a mistake when choosing their classification.

Related and alternative forms include Form 2553, which is used to elect S corporation status, and Form 8833, which is used to claim treaty-based exemptions.

The difference between Form 8832 and Form 2553 is that Form 8832 is used to choose the entity's overall tax classification, while Form 2553 is used specifically to elect S corporation status.

The form affects the future of the participants because it determines how the entity will be taxed and what tax benefits they may be eligible for. It is important to choose the right tax classification to maximize the entity's tax benefits.

The form is submitted to the Internal Revenue Service (IRS) and can be filed electronically or by mail. The form must be signed by all members or owners of the entity. The IRS stores the form electronically and it can be accessed by the entity or their authorized representative.