Form CRT-61. Certificate of Resale (Illinois)

The CRT-61 Certificate of Resale is a form used by retailers and wholesalers in Illinois to certify that they are purchasing goods for resale and are therefore exempt from paying sales tax. The main purpose of the form is to provide proof that the buyer is not the end user of the goods and is therefore not responsible for paying sales tax on the purchase.

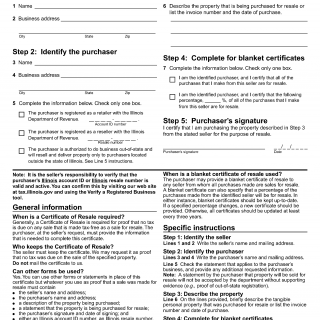

The form consists of several parts, including the buyer's name and address, the seller's name and address, a description of the goods being purchased, and a certification that the goods are being purchased for resale. The form also includes a signature line for both the buyer and the seller.

The important fields to consider when compiling the form include the buyer's name and address, the seller's name and address, the date of the transaction, and a detailed description of the goods being purchased. It is important to ensure that all of the information provided on the form is accurate and complete in order to avoid any potential issues with the tax authorities.

When compiling the form, the buyer will need to provide the seller with their Illinois Sales Tax Registration Number, which can be obtained by registering with the Illinois Department of Revenue. The seller may also request additional documentation, such as a copy of the buyer's resale certificate or a copy of their business license.

Examples of application and use cases for the CRT-61 form include a retailer purchasing inventory from a wholesaler for resale in their store, or a contractor purchasing building materials for use in a construction project. The form is a legal document and failure to provide accurate information on the form can result in penalties or fines.

Strengths of the form include its simplicity and ease of use, as well as its ability to help retailers and wholesalers avoid paying sales tax on goods that are intended for resale. Weaknesses include the potential for errors or inaccuracies on the form, as well as the need for additional documentation in some cases.

Alternative forms or analogues to the CRT-61 form include the ST-120 Resale Certificate used in New York, and the ST-10 Certificate of Exemption used in Virginia. The main differences between these forms are the specific information required and the procedures for submitting the form.

The CRT-61 form affects the future of both the buyer and the seller, as it provides proof of the transaction and can help to avoid potential issues with tax authorities. The completed form should be submitted to the seller, who will keep it on file for future reference.