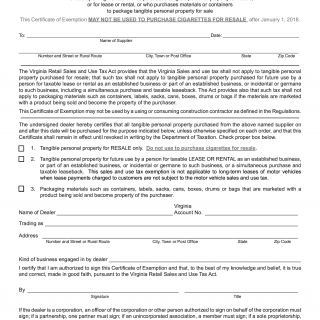

Form ST-10. Sales and Use Tax Certificate of Exemption (Virginia)

Form ST-10, also known as the Sales and Use Tax Certificate of Exemption, is a document used by businesses in Virginia to claim an exemption from paying sales and use tax on certain purchases. The main purpose of the form is to provide proof to the seller that the purchaser is exempt from paying sales and use tax.

The form consists of several parts, including the purchaser's information, the seller's information, and the reason for the exemption. The important fields to consider when compiling the form include the purchaser's name, address, and tax identification number, as well as the seller's name and address. The reason for the exemption must also be clearly stated on the form.

The parties involved in the transaction are the purchaser and the seller. The purchaser is required to provide the completed form to the seller, who will keep it on file as proof of the exemption.

When compiling the form, the purchaser will need to provide their tax identification number, as well as a description of the goods being purchased. The purchaser must also attach supporting documents, such as a copy of their tax-exempt certificate, to prove their eligibility for the exemption.

Application examples and practice and use cases include non-profit organizations, government agencies, and educational institutions. The strengths of the form include its ability to provide a streamlined process for claiming an exemption, while the weaknesses include the potential for fraud if the purchaser is not eligible for the exemption.

Alternative forms include the Form ST-12, which is used for purchases made by non-profit organizations, and the Form ST-14, which is used for purchases made by government agencies. The differences between these forms include the eligibility requirements for each type of exemption.

The form affects the future of the participants by providing proof of the exemption and ensuring compliance with sales and use tax laws. The form is submitted to the seller at the time of purchase and is kept on file for future reference.

In conclusion, the Form ST-10 Sales and Use Tax Certificate of Exemption is an important document for businesses in Virginia to claim an exemption from paying sales and use tax on certain purchases. The form consists of several parts, includes important fields such as purchaser and seller information and the reason for the exemption, and requires supporting documents to be attached. It has strengths and weaknesses, and alternative forms exist for different types of exemptions. The form affects the future of the participants and is submitted to the seller at the time of purchase.