IRS Form W-2 C. Corrected Wage and Tax Statements

Form W-2 C, Corrected Wage and Tax Statements, is a form used to correct errors on previously filed W-2 forms. The main purpose of this form is to provide accurate wage and tax information to the Social Security Administration (SSA) and the Internal Revenue Service (IRS) for employees.

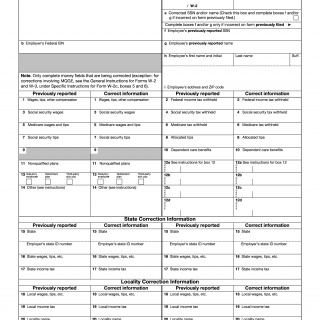

The form consists of four parts:

- Part 1 - Employee Information: This part includes the employee's name, social security number, and address.

- Part 2 - Employer Information: This part includes the employer's name, address, and employer identification number (EIN).

- Part 3 - Correction Information: This part includes the corrected information for the employee's wages, tips, and other compensation, as well as the corrected information for federal, state, and local income tax withholding, social security tax, and Medicare tax.

- Part 4 - Explanation of Corrections: This part includes an explanation of the corrections made to the W-2 form.

The important fields to consider when compiling Form W-2 C are the employee's name, social security number, and the corrected wage and tax information. The parties involved in this form are the employee and the employer.

When compiling the form, the data required includes the original information reported on the W-2 form and the corrected information. Additionally, a statement explaining the corrections made must be attached to the form.

Application examples of Form W-2 C include correcting errors in an employee's name, social security number, or wage and tax information. The practice and use cases of this form are to ensure that accurate wage and tax information is reported to the SSA and IRS.

Strengths of this form include correcting errors and ensuring accuracy in wage and tax information. Weaknesses of this form include having to file an additional form and the potential for penalties if errors are not corrected.

An example of a related form is Form W-2, Wage and Tax Statement, which is used to report an employee's wage and tax information. An alternative form is Form 1099, which is used to report income received by non-employees. The differences between Form W-2 C and Form W-2 are that Form W-2 C is used to correct errors on previously filed W-2 forms, while Form W-2 is used to report an employee's wage and tax information.

Submitting Form W-2 C involves mailing the form to the SSA and providing a copy to the employee. The form should be stored with the employer's tax records.

Overall, Form W-2 C is an important form for correcting errors in wage and tax information and ensuring accuracy in reporting to the SSA and IRS.