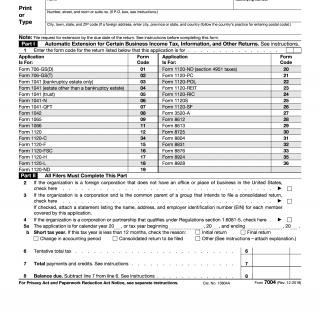

IRS Form 7004. Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns

Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, is a form used by businesses to request an automatic extension of time to file certain tax returns. The main purpose of this form is to provide businesses with additional time to file their tax returns, allowing them to avoid late filing penalties.

The form consists of three parts:

- Part 1 - Identification: This part includes the name, address, and employer identification number (EIN) of the business.

- Part 2 - Type of Return: This part includes the type of tax return for which the extension is being requested.

- Part 3 - Explanation of Extension: This part includes an explanation of why the extension is needed and the estimated amount of tax owed.

The important fields to consider when compiling Form 7004 are the type of return for which the extension is being requested and the estimated amount of tax owed. The parties involved in this form are the business and the Internal Revenue Service (IRS).

When compiling the form, the data required includes the name, address, and EIN of the business, as well as the type of return for which the extension is being requested and the estimated amount of tax owed. No additional documents need to be attached to the form.

Application examples of Form 7004 include requesting an extension for filing a partnership tax return or a corporate tax return. The practice and use cases of this form are to provide businesses with additional time to file their tax returns, allowing them to avoid late filing penalties.

Strengths of this form include providing businesses with additional time to file their tax returns and avoiding late filing penalties. Weaknesses of this form include the potential for additional interest charges if the estimated tax owed is not paid by the original due date.

An example of a related form is Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, which is used by individuals to request an extension of time to file their personal income tax returns. An alternative form is Form 2688, Application for Additional Extension of Time To File U.S. Individual Income Tax Return, which is used by individuals to request an additional extension of time to file their personal income tax returns.

Submitting Form 7004 involves mailing the form to the IRS by the original due date of the tax return. The form should be stored with the business's tax records.

Overall, Form 7004 is an important form for businesses to request an automatic extension of time to file certain tax returns, allowing them to avoid late filing penalties.