IRS Form 2210. Underpayment of Estimated Tax by Individuals, Estates and Trusts

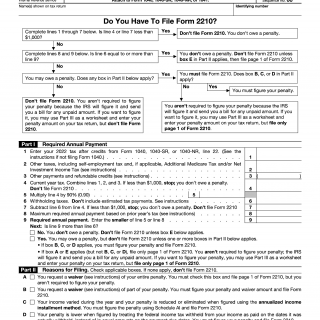

Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts, is a tax form used by taxpayers who did not pay enough estimated tax throughout the year. The purpose of this form is to calculate and report the amount of underpaid tax and any penalties or interest owed to the Internal Revenue Service (IRS).

The form consists of three parts, including the annualized income installment method, the adjusted seasonal installment method, and the adjusted seasonal installment method with recapture. The important fields include the taxpayer's name, address, tax identification number, and the amount of underpaid tax.

The parties involved in this form are the taxpayer and the IRS. It is important to consider the filing and payment deadlines, as well as the accuracy of the calculation, when compiling this form.

The data required when compiling the form includes the taxpayer's name, address, tax identification number, and the amount of underpaid tax. Additionally, the form must include the estimated tax payments made throughout the year, as well as any income received during that period.

Documents that must be attached additionally include Form 1040, which is used to report individual income tax, and Schedule A, which is used to itemize deductions.

Application examples and practice and use cases include a self-employed individual who did not pay enough estimated tax throughout the year, or an estate or trust that did not pay enough estimated tax on behalf of their beneficiaries.

Strengths of this form include the ability to accurately calculate the amount of underpaid tax and any penalties or interest owed, as well as the potential for avoiding future underpayment penalties by adjusting estimated tax payments. Weaknesses may include the complexity of the form and the potential for errors in calculating the amount of underpaid tax.

Related and alternative forms include Form 1040-ES, which is used to make estimated tax payments throughout the year, and Form W-4, which is used to adjust income tax withholding from wages.

The difference between Form 2210 and Form 1040-ES is that Form 2210 is used to calculate and report underpaid tax and any penalties or interest owed, while Form 1040-ES is used to make estimated tax payments throughout the year.

The form affects the future of the participants because it calculates and reports the amount of underpaid tax and any penalties or interest owed, which can impact future tax liabilities and financial planning. It is important to accurately calculate and report the amount of underpaid tax to avoid future penalties and interest.

The form is submitted to the IRS and can be filed electronically or by mail. The form must be filed annually by the tax filing deadline, typically April 15th. The IRS stores the form electronically and it can be accessed by the taxpayer or their authorized representative.