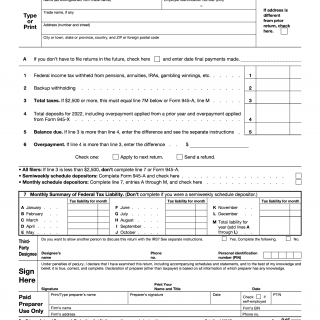

IRS Form 945. Annual Return of Withheld Federal Income Tax

Form 945, Annual Return of Withheld Federal Income Tax, is a tax form used by employers who withhold federal income tax from non-payroll payments to report their annual withholding amount to the Internal Revenue Service (IRS). The purpose of this form is to ensure that the correct amount of tax is withheld and paid to the IRS on time.

The form consists of two parts, including the summary and the detail section. The important fields include the employer's name, address, tax identification number, and the total amount of federal income tax withheld.

The parties involved in this form are the employer and the IRS. It is important to consider the filing and payment deadlines, as well as the accuracy of the withholding amount, when compiling this form.

The data required when compiling the form includes the employer's name, address, tax identification number, and the total amount of federal income tax withheld. Additionally, the form must include the type of payment, the date of payment, and the amount of tax withheld for each payment.

Documents that must be attached additionally include Form 1099-MISC, which is used to report non-employee compensation, and Form 945-A, which is used to reconcile the amount of tax withheld and deposited.

Application examples and practice and use cases include an employer who makes payments to independent contractors, such as freelancers or consultants, and must withhold federal income tax from those payments.

Strengths of this form include the ability to accurately report and reconcile the amount of tax withheld and paid to the IRS, as well as the potential for penalties and interest if the form is not filed or filed late. Weaknesses may include the complexity of the form and the potential for errors in calculating the withholding amount.

Related and alternative forms include Form 941, which is used to report payroll taxes withheld from employee wages, and Form 1099-NEC, which is used to report non-employee compensation.

The difference between Form 945 and Form 941 is that Form 945 is used to report federal income tax withheld from non-payroll payments, while Form 941 is used to report payroll taxes withheld from employee wages.

The form affects the future of the participants because it ensures that the correct amount of tax is withheld and paid to the IRS on time, avoiding potential penalties and interest. It is important to accurately report and reconcile the withholding amount to avoid any issues in the future.

The form is submitted to the IRS and can be filed electronically or by mail. The form must be filed annually by January 31st of the following year. The IRS stores the form electronically and it can be accessed by the employer or their authorized representative.