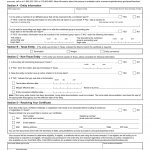

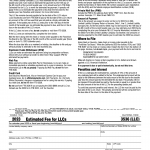

Form FTB-3536. Estimated Fee for LLCs 2023

Form 3536, also known as the Estimated Fee for LLCs form, is a document required by the Internal Revenue Service (IRS) in the United States. The primary purpose of this form is to allow Limited Liability Companies (LLCs) to estimate the amount of taxes they will owe for the upcoming tax year.