Form VTR-121. Beneficiary Designation for a Motor Vehicle

Form VTR-121 - Beneficiary Designation for a Motor Vehicle is a form used in the state of Texas to designate a beneficiary for a motor vehicle in the event of the owner's death. The main purpose of the form is to ensure that the designated beneficiary receives the vehicle's title and ownership rights upon the owner's death.

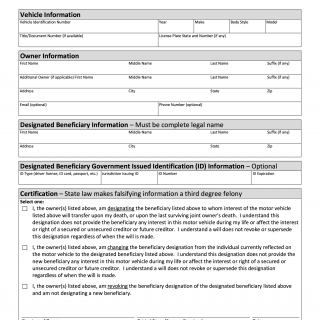

The form consists of several parts, including the vehicle information section, the owner information section, and the beneficiary information section. The vehicle information section includes details such as the make, model, year, and vehicle identification number (VIN) of the motor vehicle. The owner information section includes details about the current owner of the vehicle, including their name, address, and driver's license number. The beneficiary information section includes details about the designated beneficiary, including their name, address, and relationship to the owner.

Important fields on the form include the vehicle identification number (VIN), the owner's name and address, and the beneficiary's name and address. It is important to fill out the form accurately, as any errors or omissions may result in complications when transferring ownership of the vehicle.

The parties involved in the form include the current owner of the vehicle and the designated beneficiary.

When compiling the form, the data required includes information about the vehicle, the current owner, and the designated beneficiary. Additional documents that must be attached include a copy of the current vehicle title, proof of insurance, and a copy of the owner's driver's license.

Application examples and use cases for Form VTR-121 include situations where an individual wants to ensure that their designated beneficiary receives ownership of their motor vehicle upon their death. This form is particularly useful for individuals who have multiple beneficiaries or who want to avoid the probate process.

Strengths of the form include its ability to ensure that the designated beneficiary receives ownership of the vehicle without the need for probate, while weaknesses include the potential for errors or omissions. Opportunities for the form include the ability to simplify the transfer of ownership process, while threats include the potential for disputes over the designated beneficiary.

Related forms include a Last Will and Testament and a Transfer on Death Deed, which can also be used to designate beneficiaries for assets such as motor vehicles. The main difference between these forms is that a Transfer on Death Deed is specifically designed for real estate, while Form VTR-121 is designed for motor vehicles.

The form affects the future of the participants by ensuring that their designated beneficiary receives ownership of the vehicle without the need for probate, which can be a lengthy and costly process.

The form can be submitted in person at a Texas Department of Motor Vehicles (DMV) office or by mail to the address listed on the form. The completed form is stored in the DMV's database for record-keeping purposes.