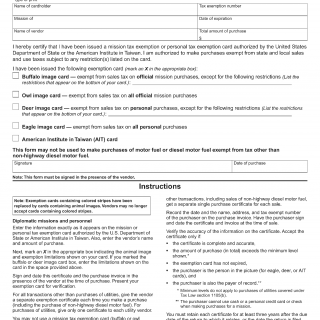

Form DTF-950. Certificate of Sales Tax Exemption For Diplomatic Missions And Personnel

DTF-950 is a Certificate of Sales Tax Exemption that enables diplomatic missions and personnel to purchase goods and services in the United States without being charged sales tax. The form is issued by the New York State Department of Taxation and Finance.

The form consists of several sections that need to be completed accurately, including details about the purchaser, the seller, and the items being purchased. There are also fields for providing information on the diplomatic mission and personnel.

It's important to note that only eligible diplomatic missions and personnel can apply for this exemption. Additionally, it's crucial to ensure that all required information is provided accurately and completely to avoid any delays or rejections of the application.

When filling out the DTF-950 form, applicants will need to provide their personal information, such as their name, job title, and diplomatic status. They will also need to include the name and address of the seller, a description of the item(s) being purchased, and the purchase price.

Depending on the specific circumstances, additional documents may need to be attached to the application. For instance, if the purchase is being made on behalf of a diplomatic mission, then a copy of the official mission order should be included.

This form is important for diplomatic missions and personnel as it allows them to purchase goods and services without incurring sales tax charges, saving them significant amounts of money. It also helps to facilitate trade between the U.S. and other countries.

One potential weakness of the DTF-950 form is that it can be time-consuming to fill out, particularly if additional documentation is required. However, the benefits of obtaining the tax exemption typically outweigh the effort required to complete the form.

An alternative form that may be used in other states is the ST-5 form, which serves a similar purpose. However, there may be slight differences in the information required, so it's important to check with the relevant state tax authority before completing any forms.

Once completed, the DTF-950 form can be submitted to the New York State Department of Taxation and Finance. It's typically stored electronically in their database for future reference.

Overall, the DTF-950 form is an essential document for diplomatic missions and personnel in the U.S., as it enables them to save money on purchases and facilitates international trade. It's important to ensure that the form is completed accurately and completely to avoid any delays or issues with the application.