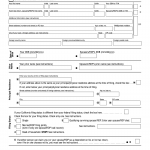

BIR Form 1905. Application for Registration Information Update/Correction/Cancellation

The BIR Form 1905 is an application for Registration Information Update/Correction/Cancellation. This form is used by taxpayers who need to update their details in the Bureau of Internal Revenue (BIR) database. The main purpose of this form is to ensure that the taxpayer's records are accurate and up-to-date, which is important for tax compliance purposes.