Form DR-15EZN. Instructions for DR-15EZ Sales and Use Tax Returns

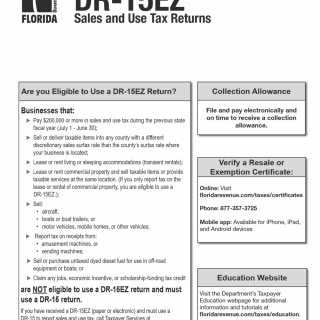

The DR-15EZN form provides instructions for completing the Sales and Use Tax Return (EZ Form) in Florida. This form is used by businesses to report their sales and use tax liability to the state.

The main purpose of the DR-15EZN is to provide guidance to businesses on how to accurately and correctly complete the DR-15EZ form. The instructions cover important topics such as who needs to file the form, what information should be included, and how to calculate the correct amount of tax due.

The instructions are broken down into several sections, including a general overview of the form and its purpose, instructions for completing each section of the form, and guidance on common issues that businesses may encounter when filing their returns.

One important aspect of the instructions is the requirement to maintain accurate records and documentation to support the information reported on the form. The instructions provide detailed information on what types of records should be kept and for how long, as well as how to properly document exempt sales or purchases.

Businesses will need to refer to the DR-15EZN instructions when completing the DR-15EZ form, as they provide essential information on how to accurately report their sales and use tax liability to the state. Failure to file the form correctly or on time can result in penalties and interest charges.

Overall, the DR-15EZN instructions play a critical role in helping businesses comply with Florida's sales and use tax laws, ensuring that they report and pay the correct amount of tax owed.