Form BOE-502-A. Preliminary Change of Ownership Report

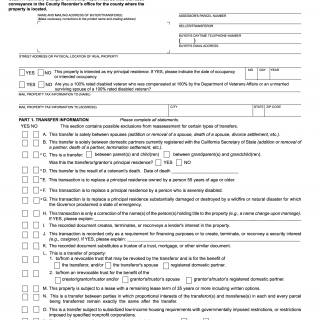

The BOE-502-A form is a Preliminary Change of Ownership Report used in California to report the transfer of real property and provide information about the new owner and the property itself. The primary purpose of this form is to notify the county assessor of any changes in ownership of real property, which can affect the assessed value of the property for tax purposes.

The form consists of several parts, including sections to provide information about the current owner, the new owner, and the property itself. Important fields on the form include the date of transfer, the consideration paid for the property, and any exemptions or exclusions claimed.

When filling out the form, it's important to consider the accuracy of the information provided, as any errors or omissions could result in penalties. Documents that may need to be attached to the form include a copy of the deed, grant deed, or other legal document establishing the change in ownership.

Examples of when this form would be required include when purchasing or selling a home, transferring ownership due to inheritance, or changing ownership due to divorce or separation. Failure to file the form within 45 days of the transfer of ownership can result in penalties.

Strengths of the BOE-502-A form include its ability to ensure that the county assessor is notified of changes in ownership, which can help maintain accurate assessments for tax purposes. Weaknesses may include the potential for errors or omissions if the form is not filled out accurately or completely.

Alternative forms that may be used include the BOE-502-D form, which is the Change in Ownership Statement form used to determine whether a transfer of ownership results in a reassessment of the property for property tax purposes. The main difference between the two forms is the type of information requested.

Once completed, the BOE-502-A form can be submitted to the county assessor's office where the property is located. The form will be stored in the assessor's records and will be used to help determine the assessed value of the property for tax purposes.

Overall, the BOE-502-A form is an important tool for ensuring that changes in ownership of real property are properly recorded and accounted for. By providing accurate information about the new owner and the property itself, this form helps maintain fair and accurate assessments for tax purposes.