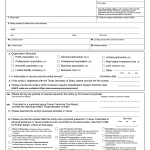

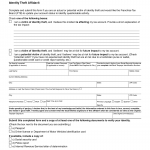

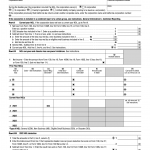

Form NC-4. Employee's Withholding Allowance Certificate

The Employee's Withholding Allowance Certificate NC-4 is a form issued by the North Carolina Department of Revenue. It serves as a means for employees to designate their tax withholding preferences for state income taxes in North Carolina.