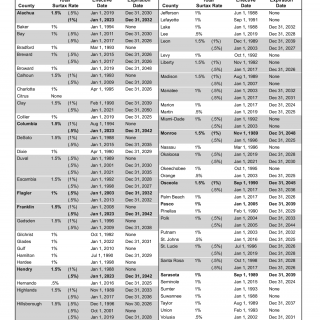

Form DR-15DSS. Discretionary Sales Surtax Information for Calendar Year 2023

Form DR-15DSS is used by businesses in Florida to report the discretionary sales surtax collected during the previous calendar year. This form provides information on the total amount of surtax collected by businesses in the state and helps local governments determine how much revenue they will receive from the surtax.

The main purpose of Form DR-15DSS is to provide accurate information on the amount of discretionary sales surtax collected by businesses in Florida. The form includes sections for reporting the total amount of surtax collected for each county, as well as information on any exemptions or exclusions that apply.

Businesses are required to submit Form DR-15DSS annually, by March 1st of the following year. Failure to file the form or filing an incomplete or inaccurate form can result in penalties and interest charges.

By submitting this form, businesses help ensure that local governments receive the appropriate amount of revenue from the discretionary sales surtax. This revenue is often used to fund local projects and services, such as schools, roads, and public safety.

In summary, Form DR-15DSS is a crucial document for businesses operating in Florida, as it helps to ensure the accurate collection and distribution of discretionary sales surtax revenue. Business owners must file this form annually and provide accurate information to avoid any penalties or interest charges.