IRS Form 14039. Identity Theft Affidavit

Form 14039, also known as the Identity Theft Affidavit, is a document issued by the Internal Revenue Service (IRS) in the United States. The main purpose of this form is to allow taxpayers to report suspected identity theft to the IRS.

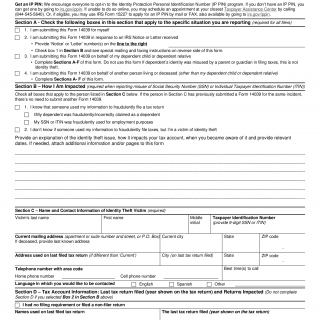

The form consists of several parts, including personal information, details of the suspected identity theft, and a statement affirming the truthfulness of the information provided. The important fields to consider when completing the form include the taxpayer's full name, date of birth, social security number, and contact information.

The parties involved in the submission of this form are the taxpayer and the IRS. It is important to provide accurate and genuine information on this form, as any false or misleading information could result in legal consequences.

When completing the Form 14039, the taxpayer may be required to provide additional documents, such as a copy of their identification documents or a police report. The application examples and use cases for this form include individuals who have reason to believe that their identity has been stolen and used for fraudulent purposes.

Strengths of this form include the ability to report identity theft and prevent further fraudulent activity, while weaknesses may include the potential for delays in the processing of the application. Opportunities for improvement may include increasing public awareness of identity theft and the importance of reporting it, while threats may include the potential for fraudulent applications or the risk of identity theft continuing undetected.

Related forms include the Form 14035, which is an Identity Theft Affidavit for Tax Professionals, and the Form 14039-E, which is an Identity Theft Affidavit for Estates and Trusts. The main difference between these forms is their purpose and the information required.

The accurate and genuine submission of this form can affect the future of the taxpayer by preventing further fraudulent activity and protecting their financial and personal information. The form is submitted to the IRS and is stored in their records.

In conclusion, Form 14039 is an important document required by the IRS to report suspected identity theft. It is important to provide accurate and genuine information on this form to ensure the success of the application and prevent further fraudulent activity.