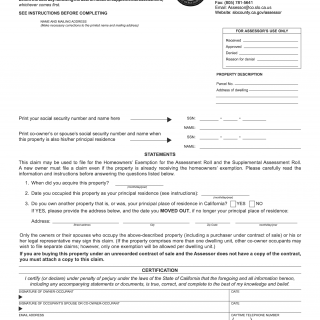

Form BOE-266. Claim for Homeowners Property Tax Exemption

The BOE-266 form is used to claim a property tax exemption for homeowners. Its main purpose is to help eligible homeowners reduce their property taxes by claiming exemptions they are entitled to.

The form consists of several sections that require important information such as the homeowner's name, address, and social security number, as well as details about the property being claimed, including its location, assessed value, and property type. In addition, the form requires detailed information about the homeowner's income, assets, and residency status in order to determine eligibility for the exemption.

It is important for homeowners to carefully read and follow the instructions on the form, as well as provide all required documentation such as proof of income and residency, and copies of property deeds or titles if applicable. Failure to provide accurate information or necessary documentation may result in the delay or denial of the exemption.

Some application examples include homeowners who are eligible for exemptions based on age, disability, or military service, as well as homeowners who qualify for exemptions due to certain types of property ownership or use, such as agricultural or historical properties.

Strengths of the BOE-266 form include the potential savings for eligible homeowners, while weaknesses may include the complexity and time required to complete the form and gather necessary documentation. Opportunities may exist for simplifying the form and reducing administrative burdens, while threats may include changes in legislation or budgetary constraints that affect the availability of exemptions.

Alternative forms or analogues could include state-specific or local property tax exemption forms, which may have different requirements or eligibility criteria.

The completion and submission of the BOE-266 form can have a significant impact on the future property tax obligations of eligible homeowners, potentially resulting in lower tax bills and increased affordability. The form is typically submitted to the county assessor's office or tax collector's office where the property is located, and may be stored electronically or in paper form depending on local policies and procedures.