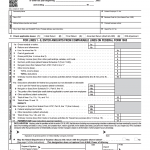

Texas Sales and Use Tax Resale Certificate

The Texas Sales and Use Tax Resale Certificate is a form used by businesses in Texas to purchase goods and services tax-free that will be resold or leased to a customer. The main purpose of the form is to allow businesses to avoid paying sales tax on items that will be resold or leased to their customers.

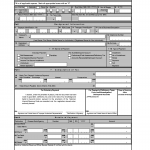

The form consists of two parts: the first part collects information about the purchaser, including their name, address, and sales tax permit number. The second part collects information about the seller, including their name, address, and the type of items being purchased.