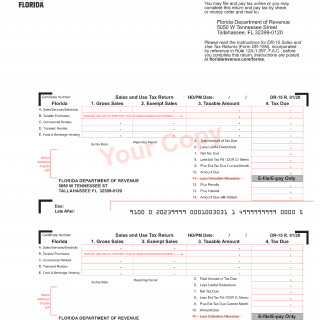

Form DR-15. Sales and Use Tax Return

The DR-15 Sales and Use Tax Return form is a document required by the Florida Department of Revenue from businesses that sell goods or services subject to sales tax. The main purpose of the form is to report the total amount of taxable sales, purchases, and use tax due for a given reporting period.

The form consists of several parts, including fields for identifying information about the business, a summary of sales and use tax activity, and the calculation of the amount of tax due. Important fields to consider when filling out the form include gross sales, taxable sales, exempt sales, and the amount of tax collected.

Parties involved in filling out the form include the business owner or authorized representative and the Florida Department of Revenue. It is important to note that failure to file the DR-15 or paying the correct amount of tax can result in penalties and interest fees.

When filling out the form, businesses will need to have accurate records of their sales and purchase transactions, including receipts, invoices, and other supporting documents. Additionally, businesses may need to attach schedules or supporting documentation to explain any adjustments or exemptions claimed on the form.

Examples of when the DR-15 may be required include retail sales, leases or rentals of tangible personal property, and certain services. Businesses with a physical presence in Florida are generally required to file the form, but there may be exceptions based on the nature of the business and the types of transactions conducted.

Strengths of the DR-15 form include its clear and detailed instructions, which make it easier for businesses to report their sales and use tax activity accurately. Weaknesses may include the potential for errors or miscalculations if businesses do not maintain accurate records or properly apply exemptions.

Alternative forms or analogues to the DR-15 may include state-specific sales tax returns in other states or the IRS Form 1040 Schedule C, which reports business income and expenses. Differences between these forms may include variations in reporting requirements, tax rates, and deadlines.

Submitting the DR-15 can be done electronically or by mail, and businesses are required to keep copies of the form and supporting documentation for at least three years. The form's submission can affect a business's future ability to obtain licenses or permits from the state, so it is important to file and pay the correct amount of sales and use tax due on time.