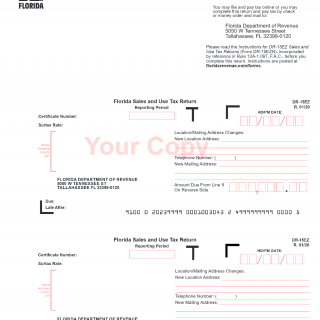

Form DR-15EZ. Sales and Use Tax Return (EZ Form)

The DR-15EZ form is a Sales and Use Tax Return (EZ Form) used for reporting sales and use tax in the state of Florida. This form is designed to simplify the tax return process for businesses with a low tax liability.

The form consists of several parts, including basic information about the business, the total amount of taxable sales, and the tax due. The form also includes fields for reporting any exempt sales or purchases made during the reporting period.

It is important to consider several factors when filling out this form, including ensuring that all sales and use tax collected during the reporting period are included on the form and that any exemptions claimed are legitimate. In addition, it is important to maintain accurate records and documentation to support the information reported on the form.

When filling out the DR-15EZ form, businesses will need to provide basic information about their business, including their name, address, and taxpayer identification number. They will also need to provide details about their taxable sales during the reporting period, as well as any exempt sales or purchases.

While there are no additional documents that must be attached to the DR-15EZ form, businesses should keep detailed records and supporting documentation in case of an audit.

Businesses of all sizes may need to file the DR-15EZ form, but it is particularly useful for small businesses with a relatively low tax liability. Examples of businesses that may need to file this form include retail stores, restaurants, and online sellers.

One strength of the DR-15EZ form is its simplicity, making it easy for businesses to complete and submit their tax returns. However, one weakness is that it may not be suitable for businesses with more complex tax situations.

Alternative forms that businesses may need to file include the standard DR-15 form for reporting all sales and use tax, as well as various other forms for reporting specific types of transactions or taxes.

Filing the DR-15EZ form accurately and on time is important for avoiding penalties and interest charges. The form can be submitted online through the Florida Department of Revenue's website, and businesses should keep a copy of their completed form for their records.

Overall, the DR-15EZ form plays an important role in ensuring that businesses in Florida comply with state sales and use tax laws, and its continued use will likely impact the financial future of businesses and the state as a whole.