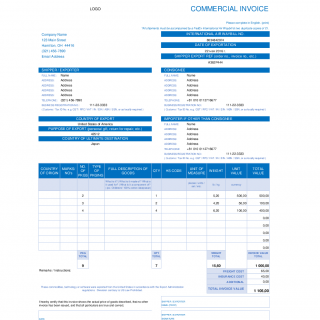

Commercial Invoice

A Commercial Invoice is a document used in international trade that provides essential information about the goods being shipped. It contains a full description of the products, their value, and any other pertinent details needed to clear customs. Below is a detailed description of the above form.

Parts of a Commercial Invoice:

- Shipper and consignee details

- A description of the goods being shipped

- The quantity, weight, and unit price of each item

- Any taxes, duties, or fees associated with the shipment

- Payment terms and methods

- Shipment date and transportation details

- Total value of the shipment

- Signature of the exporter or their authorized representative

Cases when Commercial Invoice is drawn up

A Commercial Invoice is typically drawn up when goods are being shipped internationally, either for sale or distribution. It is an essential document for customs clearance and provides the buyer with important information for payment processing and record-keeping.

Parties involved

The Commercial Invoice is typically prepared by the seller or exporter and sent to the buyer or importer. It may be required by customs officials, freight forwarders, or other intermediaries involved in the shipment.

Features to consider when compiling

When compiling a Commercial Invoice, it is important to ensure that all information is accurate and complete. The description of the goods should be detailed and specific, including any unique identifiers or product codes that may be required. The value of the items should be correctly calculated, taking into account any discounts, rebates, or other adjustments that may apply.

Advantages of Commercial Invoice

The Commercial Invoice serves multiple purposes in international trade. It provides a clear record of the details of the goods being shipped, including their value and other important information. It also serves as a legal document that can be used in arbitration, litigation, or other legal proceedings. Additionally, it helps to facilitate customs clearance and payment processing.

Problems if the form is filled out incorrectly

If a Commercial Invoice is filled out incorrectly, it can cause serious problems in the shipment process. It may result in delays in customs clearance or payment processing, and may even lead to penalties or fines. Incorrectly valuing the goods could lead to incorrect taxation or customs duties, causing financial loss to both parties. Therefore, it is important to ensure that the Commercial Invoice is prepared accurately and conforms to all applicable regulations and requirements.

What is the difference between consular invoice and commercial invoice

The primary differences between the two are:

- Purpose: A commercial invoice is used to provide details of the goods being shipped, including the quantity, value, description, and other relevant information. It is used to determine the customs duties and taxes that will be charged on the shipment. A consular invoice, on the other hand, is a document that is required by some countries for specific goods and is used to certify the origin, value, and nature of the goods being shipped.

- Certification: A commercial invoice is issued by the seller or exporter and is not required to be certified by any authority. A consular invoice, on the other hand, is required to be certified by the consulate or embassy of the country to which the goods are being shipped. The certification process involves verifying the details of the shipment and ensuring that it complies with the regulations of the importing country.

- Cost: A commercial invoice is typically provided by the seller or exporter free of charge as part of the sales transaction. A consular invoice, however, may involve additional fees for certification and other related services.

- Legal requirements: While a commercial invoice is a standard document that is required for most international trade transactions, a consular invoice is only required by some countries and for specific goods. It is important to check the legal requirements of the importing country to determine if a consular invoice is required.

In summary, a commercial invoice is a document that provides details of the goods being shipped and is used to determine customs duties and taxes, while a consular invoice is a document required by some countries to certify the origin, value, and nature of the goods being shipped and is certified by the consulate or embassy of the importing country.

What is the difference between proforma invoice and commercial invoice

A proforma invoice and a commercial invoice are two types of invoices that are used in different situations in business transactions.

A proforma invoice is a preliminary invoice that is sent to a customer before the actual sale takes place. It is used to provide the customer with a quote for the goods or services that they are interested in purchasing. The proforma invoice includes a description of the goods or services, the quantity, the price, and any other terms and conditions that may apply. This type of invoice is not a legal document and does not require payment.

On the other hand, a commercial invoice is a legal document that is used to record the actual sale of goods or services. It is issued by the seller to the buyer after the transaction has taken place. The commercial invoice includes a description of the goods or services, the quantity, the price, and any other terms and conditions that may apply. This type of invoice is used for customs clearance and payment purposes.

In summary, the main difference between a proforma invoice and a commercial invoice is that a proforma invoice is a preliminary invoice that is used to provide a quote to a customer before the sale takes place, while a commercial invoice is a legal document that is used to record the actual sale of goods or services.