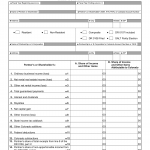

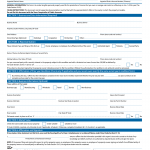

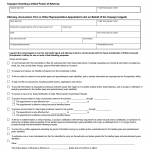

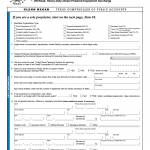

Form 50-246. Dealer's Motor Vehicle Inventory Tax Statement

The Form 50-246, Dealer's Motor Vehicle Inventory Tax Statement, is a document used in Texas to report the inventory of motor vehicles held for sale by licensed motor vehicle dealers. The form consists of several parts that must be completed with accurate information about the dealer's inventory, such as the make, model, year, and vehicle identification number (VIN) of each vehicle.