Texas Taxes 01-42-index Forms

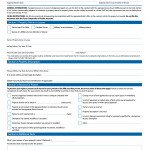

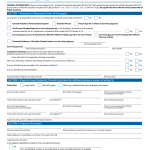

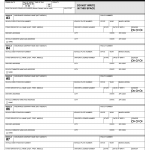

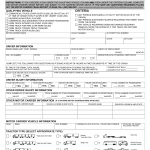

When it comes to doing business in the state of Texas, there are a number of forms that businesses may need to fill out and submit. These forms cover a wide range of topics, from sales and use tax returns to refund claims and exemption certificates. In this list, we'll take a look at some of the most common forms that businesses operating in Texas may need to use.