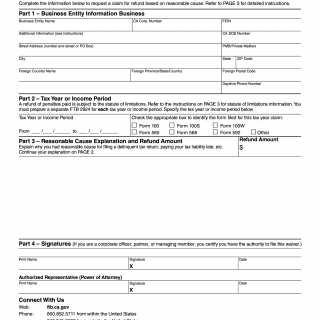

Form FTB-2924. Reasonable Cause - Business Entity Claim for Refund

The Form FTB-2924 is a tax form used by business entities in California to claim a refund due to reasonable cause. The main purpose of the form is to provide a way for businesses to request a refund when they have overpaid their taxes and can show that they had reasonable cause for doing so.

The form consists of several important fields that must be filled out correctly, including the taxpayer's name, address, and identification number, as well as a detailed explanation of the reasonable cause for the refund request. It is important to consider the specific circumstances that led to the overpayment when filling out this form, as the explanation provided will be closely scrutinized by the tax authorities.

When filling out the form, the business entity will need to provide documentation to support their claim for a refund due to reasonable cause. This may include invoices, receipts, bank statements, or other financial records. It is also important to attach any additional forms or schedules that are relevant to the refund request.

Examples of situations where a business might use this form include overpayment of estimated taxes, errors in tax calculations, or changes in tax law that retroactively affect the business's liability. By claiming a refund due to reasonable cause, businesses can recoup funds that were improperly paid to the government.

Strengths of this form include its clear and concise instructions, which make it relatively easy for businesses to complete. Weaknesses may include the level of scrutiny applied to refund requests, which can lead to delays or denials of claims. Opportunities for improvement could include streamlining the process of providing documentation to support refund requests.

Alternative forms that may be used in similar situations include the Form 540X and Form 100S, both of which are used to amend tax returns. However, these forms may not be appropriate for all situations where a refund due to reasonable cause is warranted.

Once completed, the Form FTB-2924 is submitted to the California Franchise Tax Board. The form is stored electronically in the agency's database, and the business entity will receive a notice of action indicating whether their refund request has been approved or denied. The outcome of this process can have significant financial implications for the business, so it is important to ensure that the form is completed accurately and all required documentation is provided.