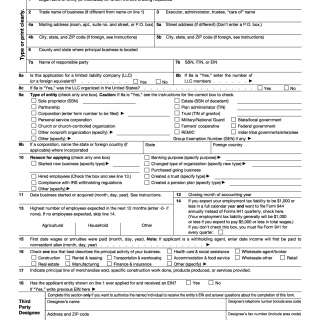

IRS Form SS-4. Application for Employer Identification Number (EIN)

Form SS-4 is an application for an Employer Identification Number (EIN) used to identify a business entity for tax purposes. The form consists of several parts, including general information about the business, the reason for applying, and the type of entity. The important fields to consider when completing the form include the legal name and address of the business, the type of entity, and the reason for applying for an EIN. The parties involved are the business entity and the Internal Revenue Service (IRS).

When filling out the form, it is important to have accurate information about the business and its structure. The data required when filling out the form includes the legal name and address of the business, the type of entity, the name and social security number of the responsible party, and the reason for applying for an EIN. Additionally, certain types of entities may require additional documentation, such as articles of incorporation or a partnership agreement.

Examples of when Form SS-4 might be required include when starting a new business, changing the structure of an existing business, or hiring employees. Strengths of the form include providing a unique identifier for the business and simplifying the tax filing process, while weaknesses include potential delays in processing and the need for accurate record-keeping.

Alternative forms or analogues may include state-specific tax forms or other federal tax forms such as Form W-9. The main difference is that Form SS-4 is used specifically to apply for an EIN, while other forms may be used for different tax-related purposes.

The form can be filled and submitted electronically through the IRS website or by mail, fax, or phone. It is important to note that the IRS does not charge a fee for applying for an EIN. Once processed, the EIN will be provided to the business entity and stored electronically by the IRS.