IRS Form 8888. Allocation of Refund

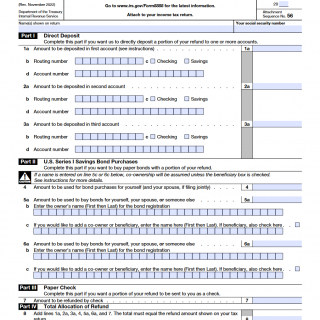

IRS Form 8888, also known as "Allocation of Refund (Including Savings Bond Purchases)," is a form that allows taxpayers to divide their federal tax refund into multiple accounts or to use a portion of it to buy U.S. savings bonds. The form consists of three parts: Part I, which is used to allocate the refund among up to three accounts; Part II, which is used to designate the type of account and provide account information; and Part III, which is used to request the purchase of U.S. savings bonds.

When completing Form 8888, taxpayers should consider the parties involved, which include the taxpayer and the financial institution(s) where the refund will be deposited. Important fields to consider when filling out the form include the taxpayer's personal information, including their name, Social Security number, and address, as well as the account information for each account or savings bond purchase.

Taxpayers will need to provide the necessary account information, such as the account number and routing number, for each account they wish to allocate their refund to. If requesting the purchase of U.S. savings bonds, taxpayers will need to provide the bond owner's information, including their name, Social Security number, and address, as well as the bond type and denomination.

When submitting Form 8888, taxpayers may need to attach additional documentation, such as a voided check for each account or a completed IRS Form 8888-T, which is used to request a refund transfer to a TreasuryDirect account.

Examples of application and use cases for Form 8888 include taxpayers who want to divide their refund among multiple accounts, such as a checking account and a retirement account, or taxpayers who want to use a portion of their refund to purchase U.S. savings bonds as a long-term savings strategy.

Strengths of Form 8888 include its flexibility in allowing taxpayers to allocate their refund among multiple accounts or savings bonds. Weaknesses may include the potential for errors if the taxpayer provides incorrect account information or fails to attach necessary documentation.

Related and alternative forms to Form 8888 include IRS Form 8888-T, which is used to request a refund transfer to a TreasuryDirect account, and IRS Form 8888-C, which is used to change a previously submitted Form 8888. The main difference between these forms is the type of refund allocation or transfer requested.

To fill and submit Form 8888, taxpayers should carefully review and complete all necessary fields, attach any required documentation, and mail the form to the appropriate IRS address. A copy of the form should be kept for the taxpayer's records.