IRS Form 720. Quarterly Federal Excise Tax Return

Form 720 is a Quarterly Federal Excise Tax Return that is used to report and pay excise taxes on certain goods and services. The main purpose of this form is to ensure that businesses and individuals who engage in activities that are subject to excise taxes are properly reporting and paying these taxes to the IRS.

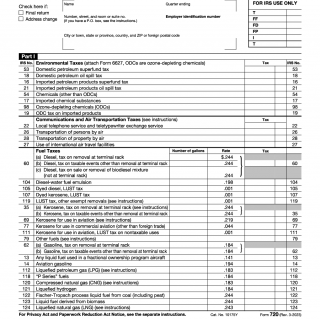

The form consists of several parts, including Part I, which covers the environmental taxes, Part II, which covers communications and air transportation taxes, and Part III, which covers fuel taxes. There are also additional sections for certain other excise taxes.

When completing Form 720, it is important to consider the specific taxes that apply to your business or individual activities. This may include taxes on gasoline, diesel fuel, alcohol, tobacco, firearms, and more. You will need to gather data on your sales or usage of these products and calculate the appropriate tax owed.

In addition to the form itself, you may need to attach additional documents such as schedules or statements to support your tax calculations. It is important to keep accurate records and maintain these documents for future reference.

Some examples of when Form 720 might be required include businesses that sell gasoline or tobacco products, airlines that transport passengers or cargo, and manufacturers of firearms or alcohol.

Strengths of Form 720 include its ability to ensure that excise taxes are properly reported and paid, which helps to fund important government programs. Weaknesses may include the complexity of the form and the need for accurate record-keeping.

Alternative forms or analogues to Form 720 may include state-specific excise tax forms or other federal tax forms such as Form 2290 for heavy vehicle use tax. The main difference between these forms is the specific taxes that they cover and the reporting requirements.

To fill and submit Form 720, you can either do so electronically through the IRS e-file system or by mailing a paper form to the appropriate address. Once submitted, the form will be stored electronically by the IRS for future reference and auditing purposes.