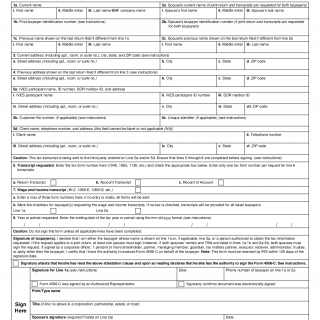

IRS Form 4506-C. IVES Request for Transcript of Tax Return

Form 4506-C is an IRS document used to request a transcript of a tax return for verification purposes. The main purpose of this form is to allow authorized third parties to request a transcript of a tax return from the IRS for verification purposes.

The form consists of several parts, including personal details, signature, and authorization. The important fields on this form include the applicant's name, address, social security number, and authorization to release the transcript to a third party.

The IVES abbreviation stands for "Income Verification Express Service." It is a service provided by the Internal Revenue Service (IRS) that allows mortgage lenders and other authorized third-party requesters to quickly obtain tax return transcripts for loan applicants. The IVES program helps streamline the loan underwriting process by providing an efficient way to verify an applicant's income information.

The parties involved in this form are the applicant, the third party requesting the transcript, and the IRS. It is important to consider that only authorized third parties such as mortgage lenders, financial institutions, and government agencies are eligible to request a transcript.

When filling out this form, the applicant will need to provide personal details and authorization for the release of the transcript. Additionally, they may need to attach supporting documents such as a power of attorney or a written request from the third party.

An example of an application for this form could be a mortgage lender who needs to verify a borrower's income by requesting a transcript of their tax return. By completing this form and providing authorization, the lender can request the transcript from the IRS and verify the borrower's income for the loan application.

Strengths of this form include the ability to verify income and other financial information for authorized third parties. However, weaknesses include the need for authorization and potential delays in processing the request.

Alternative forms to this include the Form 4506-T, which is used to request a transcript of a tax return for the taxpayer's own use, and the Form 4506, which is used to request a copy of a tax return.

To fill and submit this form, the applicant must complete all required fields and attach any supporting documents. Once completed, the form can be submitted online or through the mail to the IRS. The form will be stored in the IRS's database.