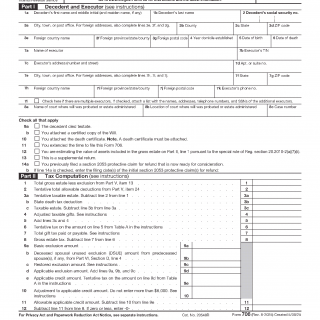

IRS Form 706. United States Estate (and Generation-Skipping Transfer) Tax Return

IRS Form 706 is the federal estate tax return used to report the value of a decedent’s gross estate and to determine estate tax and generation-skipping transfer tax consequences under United States tax law. The form serves as the official mechanism through which the Internal Revenue Service records how property, transfers, deductions, and statutory elections are applied at death.

Purpose of IRS Form 706

The purpose of Form 706 is to establish the estate’s tax position within the federal estate and GST tax system. The return documents what property is included in the gross estate, how that property is valued, which deductions and credits apply, and whether any elections affecting future tax consequences are made. The form provides the official record used by the Internal Revenue Service to assess compliance with estate tax rules.

When IRS Form 706 is used

Form 706 is used when a decedent’s estate falls within statutory filing requirements or when filing is necessary to preserve elections recognized by the estate tax system. The obligation to file may arise even when no estate tax is ultimately due, because the system requires a completed return to confirm values, deductions, or elections.

How the form functions within the tax system

Form 706 operates as a structured reporting framework rather than a single calculation. Property interests connected to the decedent are identified and reported across multiple schedules according to asset type and legal classification. After the gross estate is established, the form applies allowable reductions, deductions, exclusions, and credits before producing a final estate tax and GST tax result.

Structure of IRS Form 706

The form consists of a main return and a series of schedules used to report specific categories of property, transfers, deductions, and tax adjustments. Each schedule corresponds to statutory provisions that govern how different interests are treated within the estate tax system. The combined schedules determine the estate’s total taxable value and tax outcome.

Official source and filing authority

IRS Form 706 is issued and administered by the Internal Revenue Service as part of the federal estate tax framework. The form, instructions, and related guidance are maintained by the Internal Revenue Service and updated as statutory rules and administrative procedures change.

For practical explanations of how this form is used in real filing scenarios and how its schedules operate together, see the related guidance available in Form 706 practical notes.