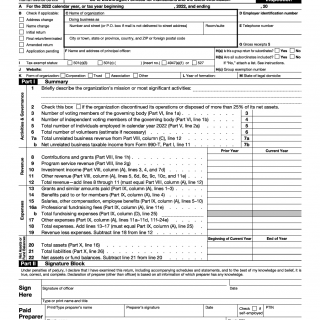

IRS Form 990. Return of Organization Exempt from Income Tax

Form 990, Return of Organization Exempt from Income Tax, is a tax form used by tax-exempt organizations in the United States to report their financial activities to the Internal Revenue Service (IRS). The main purpose of this form is to provide transparency and accountability for tax-exempt organizations, as well as to ensure compliance with tax laws.

The form consists of several parts, including Part I, which provides information about the organization's mission, governance, and activities; Part II, which provides information about the organization's compensation practices; and Part III, which provides information about the organization's program services and accomplishments.

Some of the important fields that need to be carefully considered when completing the form include the organization's name, address, and identification number; the organization's tax-exempt status; and details about the organization's revenue, expenses, and assets.

The parties involved in completing the form include the tax-exempt organization, its officers and directors, and its accountant or tax preparer.

When filling out the form, the organization will need to have detailed financial records, including information about its revenue, expenses, and assets. Additionally, the organization may need to attach additional documents, such as a balance sheet and income statement.

Application examples of Form 990 include charities, religious organizations, and other tax-exempt organizations that are required to file the form annually. One strength of the form is that it provides transparency and accountability for tax-exempt organizations, which can help build public trust. However, one weakness is that the form can be complex and time-consuming to complete, especially for smaller organizations.

Related forms include Form 990-EZ, which is a shorter version of Form 990 for smaller organizations, and Form 990-PF, which is used by private foundations. Alternative forms include Form 990-N, which is a simplified electronic form for small tax-exempt organizations with gross receipts of $50,000 or less.

To fill and submit the form, the organization will need to download the form from the IRS website, complete it, and submit it by the appropriate deadline. The form is stored in the IRS database and can be accessed by the public.